In an environment where traditional yields remain compressed and equity markets trade with elevated volatility, leverage has become an increasingly popular tool for investors looking for more returns. Leveraged ETFs have made this access simple by offering 2x or 3x daily exposure to major indices such as the Nasdaq (QQQ).

Leveraged ETFs provide simple access to magnified equity exposure but their structural design brings inefficiencies that are overlooked. In contrast, perpetual futures perps provide a different exposure model, one that behaves linearly and avoids daily mechanical rebalancing.

Leveraged ETFs Are Not True Delta One Instruments

Leveraged ETFs promise a multiple of an index’s daily return, not its cumulative performance over time.

To maintain constant leverage, these funds rebalance their exposure at the end of each trading day:

If the market rises, the fund increases exposure by purchasing additional assets.

If the market falls, the fund reduces exposure by selling assets.

This daily reset mechanism ensures the leverage ratio remains constant, but it introduces a systematic effect: the fund mechanically buys after gains and sells after losses.

In volatile markets this creates structural inefficiencies.

Perpetual Futures: A Linear Leverage Structure

Perpetual futures operate under a structurally different framework.

Unlike leveraged ETFs, perpetual futures do not mechanically rebalance exposure at the end of each trading session. Profit and loss are determined by a simple linear relationship:

PnL = (Exit Price − Entry Price) × Position Size

If the underlying asset moves 1%, equity moves approximately 1% multiplied by leverage, assuming constant notional exposure. This makes perpetual futures true delta one instruments by providing direct and proportional exposure to price movements.

It is important to note that leveraged compounding affects all leveraged instruments, including perpetual futures. For example, if an index declines 10% and then rises 11.1%, it returns to its starting level. However, at 3x leverage, a 30% decline followed by a 33.3% gain results in equity of $93.31 rather than $100. This path dependency stems from the maths of percentage losses: larger drawdowns require disproportionately larger recoveries.

Where perpetual futures differ is not in eliminating compounding, but in avoiding the additional structural drag introduced by daily reset mechanisms. Leveraged ETFs mechanically reduce exposure after losses and increase exposure after gains. Over extended periods of volatility, this rebalancing process compounds decay beyond simple leveraged path dependency.

The linearity of perpetual futures therefore makes them structurally cleaner than daily reset ETFs, while still requiring disciplined risk management.

Accounting for Funding Costs

A common objection to perpetual futures is the funding rate. While leveraged ETFs embed financing within their structure, perpetual futures apply an explicit funding mechanism between long and short participants.

To evaluate whether funding offsets the structural advantage of constant notional exposure, consider the following 31 day scenario:

Number of days: 31

Daily price growth: alternates between +2% and −2%

Leverage: 3x

Funding rate for perp: 7% (annualized)

Expense ratio for leveraged ETF: Free

Leverage cost for leveraged ETF: Free

The chart below illustrates the resulting performance paths.

As shown the equity curve of the leveraged ETF falls below that of the perpetual exposure once chop begins starting from Day 2 onward. By Day 27, cumulative returns of the leveraged ETF underperform the index despite positive price growth on the day. By Day 31, the perpetual structure outperforms the leveraged ETF by approximately 1.95ppt, even after incorporating a 7% annualized funding rate.

The divergence is driven by the daily reset mechanism embedded in ETFs which compounds decay during oscillating market conditions.

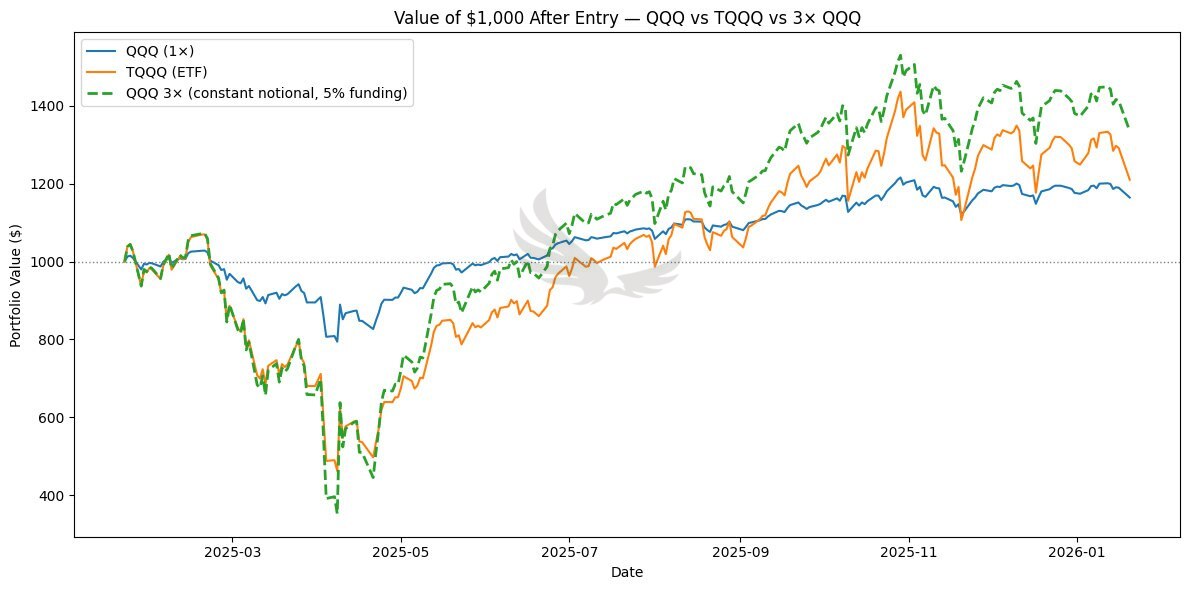

Historical Comparison: QQQ vs TQQQ vs Constant Notional Exposure

To move beyond a theoretical chop scenario, we analyze historical performance of QQQ, TQQQ, and a simulated 3x constant notional QQQ exposure under a 5% funding rate assumption.

The chart below illustrates this comparison over a 12 month backtest period.

You can clearly observe how short term volatility and chop drag a predominantly upward trending chart through the mud, even at modest 3x leverage. Leveraged ETFs are structurally constrained whereas perpetual futures allow materially higher leverage including 10x or 20x depending on margin requirements.

So just DCA into perps?

Not necessarily. While perpetual futures avoid daily rebalancing decay and can offer structurally cleaner exposure, they introduce liquidation risk. Excessive leverage can result in forced position closures, turning short term volatility into permanent capital loss. This is a risk profile fundamentally different from the gradual decay in leveraged ETFs.

However in a traditional finance context particularly in regimes where single equities experience high intra week volatility while the broader market trends upward perpetual futures can provide a more efficient leverage framework than daily reset ETFs